Alpha International Communication, LLC, Full-Scale Launch of Microfinance Business in the Philippines

SEC-registered local lender x In-house operations to Expand access to funds "quickly, flexibly, and fairly

アルファインターナショナルコミュニケーション合同会社

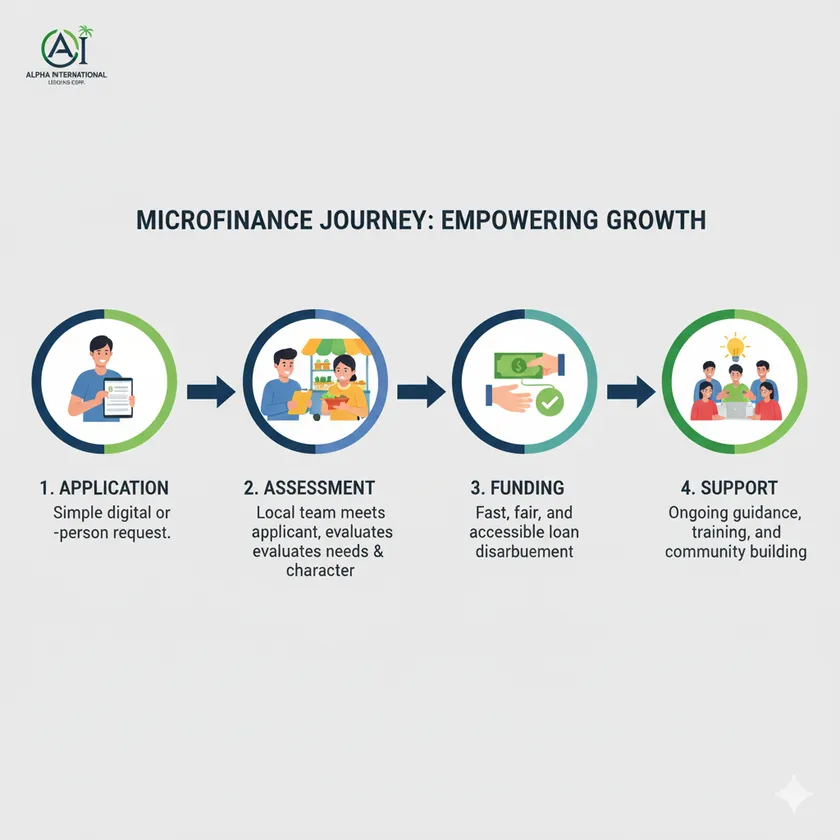

Alpha International Communication LLC (Location: Inuyama City, Aichi Prefecture; Representative Partner: Masaki Okumura; hereinafter referred to as AIC) has launched its microfinance business in the Philippines through a local money lending company, Alpha International Lending Corp. AIC completed its registration with the Philippine SEC in January 2025, and is able to provide microfinance services to individuals and micro businesses that are difficult for existing banks to reach through its own local team, which handles everything from application, screening, on-site verification, execution, and collection. The company's local team manages the entire process from application, screening, on-site verification, execution, and collection, enabling it to provide small, flexible loans to individuals and micro businesses that are difficult to reach through existing banks.

Microfinance Overview: https://a-icom.com/microfinance-services/

On-site microfinance

Masaki Okumura, Representative Director

We are a company that not only invests capital, but also goes the "last mile" ourselves. By running our own on-site operations, we design repayments that match the seasonality of the loan, execute credit quickly, and accompany the borrower so that the loan leads to real benefits (sales and improved livelihoods)."

■Business framework (what, to whom, how to deliver)

Targets

Micro SMEs such as food stalls, retail, repairs, and services, self-employed persons, municipal employees, and households with financing needs for daily necessities such as education, medical care, and housing improvement

● Products

Working capital, inventory purchase, bridge (bridge waiting for payment), essentials (education/healthcare/housing environment)

Conditions

Small amount/short- to medium-term, weekly, bi-weekly, or monthly, no prepayment penalty, reschedule design based on seasonality

●Speed

Brief application → On-site confirmation by local staff → Execution on the same day or in a few days (target SLA)

● Price/Yield

Current loan portfolio achieves average monthly effective interest rate of approx. 5% (including fees, etc.) Ticket size and repayment frequency are designed to be borrower friendly while achieving capital efficient unit economics. Rates are operated with disclosure and regulatory compliance.

■AIC's Strengths (4 Differentiators)

1. in-house local operations

In-house staff performs credit, field verification, collection, and re-credit. Decision-making is faster, and risk management based on contextual understanding is possible. 2.

2. accumulation of on-site knowledge in the Philippines

Knowledge of business distribution, regulations, and consumer behavior accumulated through 4 businesses (real estate related, diaper import and sales (A+ BABY), wellness products import and sales, and foreign human resources) is horizontally deployed in scoring and operations. 3.

3. start small and learn fast

High-speed cycle of test->learn->redesign with cohort operations. Search for optimal point of repayment rate x customer outcomes.

4. room for technology

Phase in eKYC / mobile collections / lightweight scores / audit dashboard with procurement funds. Human x digital to achieve both quality and scale.

AIC Portfolio

■ Risk management and governance

Tiered credit (initial small amount → limit expansion based on performance)

Diversified portfolio (diversified by region, industry, and repayment cycle)

Early warning and redesign (early detection of signs of delinquency → rescheduling → re-credit decisions)

Transparency in use of funds (ring-fencing of loan resources/periodic reporting)

Use of procured funds

(1) Strengthening of local structure: hiring and training, development of SOPs for credit/collections

2. technology implementation: eKYC, scores, mobile collections, visualization dashboard

3. loan source: expansion of operational framework on a cohort basis

■ Target partners/investors

To those who value "inclusive x capital efficiency":

Businesses that have consumer finance know-how and are looking to expand overseas (utilizing a yield profile with an average monthly effective interest rate of approximately 5%)

Business companies and funds that invest in emerging markets/impact investments (scalable unit economics + robust governance)

● Angel investors (interested in models with fast learning loops and clear risk management)

■ Existing businesses related to the Philippines (backing of local knowledge)

Real estate related : https://a-icom.com/aird/

Diaper import and sales (A+ BABY): https://a-icom.com/alpha-international-trading/

Import and sales of wellness products : https://a-icom.com/healthy-life/

Foreign human resource introduction: https://a-icom.com/global-caregiver/

Microfinance overview: https://a-icom.com/micro-finance/

Company Profile

Company Name : Alpha International Communication LLC

(Alpha International Communication LLC)

Representative: Masaki Okumura, Representative Partner

Location: 56 Tenpakucho, Maruyama, Inuyama, Aichi, 484-0072, Japan

Business : Global Human Resource Development / Healthy Life Extension / Import/Export Retail / Overseas Real Estate / Microfinance

Microfinance

Last Mile Finance

For inquiries regarding this matter, please contact

AIC Public Relations (for inquiries about partnerships and investment)

Email: masaki@a-icom.com

TEL : 090-5817-4397

- Category:

- Corporate Trends

- Genres:

- General Business Finance Economy(Japan)