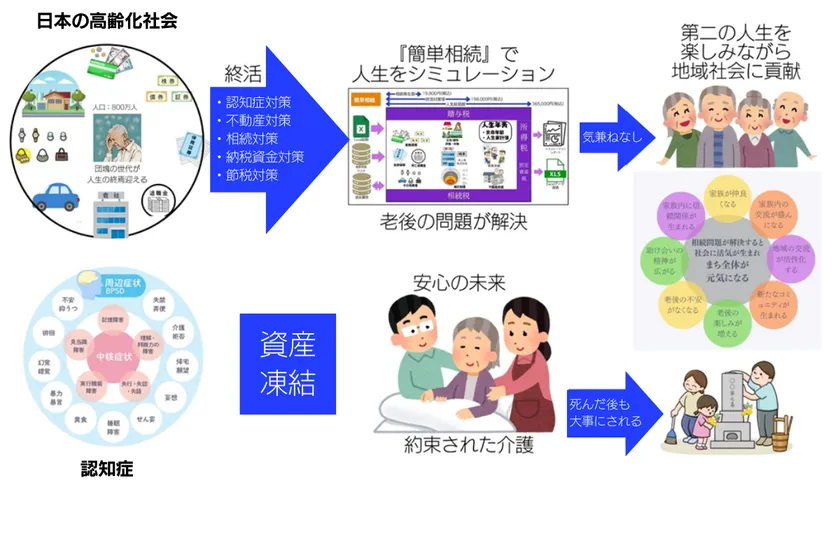

Achieving a Lively and Well-Planned Retirement Simulation software "Easy Inheritance Starts recruiting tie-up companies.

-Asset management simulation before dementia.

ミラーマスター合同会社

Mirror Master LLC (Location: Ichihara City, Chiba Prefecture; Representative Partner: Takamasa Kagami) has announced that its inheritance tax calculation simulation software "Easy Inheritance" which enables asset management even after dementia and opens up a new era, will be available at the "3rd Business Audition" held on December 22, 2024, in Ichihara City, Chiba Prefecture. The company is now accepting applications for tie-up companies.

URL: https://www.youtube.com/live/eQMp5NB7Rxg?si=Mo72yOkGj_L-L_en&t=6358

Image of "Easy Inheritance

About "Easy Inheritance

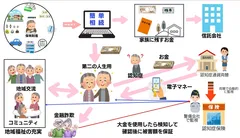

Easy Inheritance" is an inheritance tax calculation simulation software for individuals developed by Miller Master, LLC. It is scheduled to offer three different functions to suit different inheritance situations: an "inheritance occurrence version" for those who have received an inheritance, and a "End of Life measures planning" for those who are about to start their lifetime.

The launch of the third product, "Life Summary Version," aimed at those who are considering post-dementia preparation, and the start of recruiting tie-up companies, were announced at the "3rd Business Audition" held in Ichihara City, Chiba Prefecture, on December 22, 2024.

Details of Development

(1) Aimed functions of "Easy Inheritance

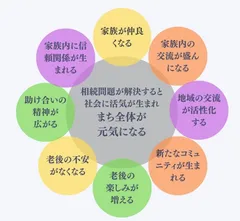

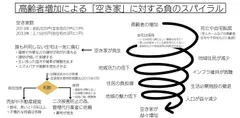

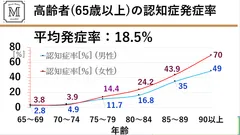

According to the Ministry of Health, Labor and Welfare (MHLW), one in five persons aged 65 or older and one in two persons aged 90 or older suffer from dementia (*1), and the number is expected to increase over the next 15 years.

(*2) When dementia occurs, assets will be frozen and all asset transfers and legal actions will become invalid, placing a heavy burden on the individual and his/her family. It is necessary to prepare for inheritance before this happens, but the current system has its advantages and disadvantages, leaving dissatisfaction with asset management after the onset of dementia. By planning assets in advance, both the decedent and his/her family will be able to face inheritance with peace of mind.

(*1) Prime Minister's Official Website, "Trends in Prevalence of Dementia by Age Group, etc."

https://www.kantei.go.jp/jp/singi/ninchisho_kaigi/yusikisha_dai2/siryou1.pdf

(*2) Ministry of Health, Labor and Welfare, Bureau of Health and Welfare, "Comprehensive Promotion of Dementia Policies (Reference Material)".

https://www.mhlw.go.jp/content/12300000/000519620.pdf

The above information is also introduced in detail in a dialogue with Ms. Mao Miyaji in the January 2025 issue of Company Tank.

URL: https://www.challenge-plus.jp/interview/202501/c0070/

Company Tank interview

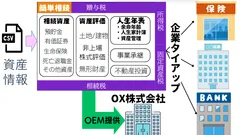

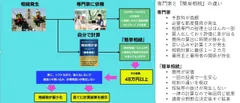

(2) Background of the tie-up

We are looking for companies that are willing to become our business partners and encourage the introduction of "Easy Inheritance" in anticipation of the patent application to be filed in January 2025. Inquiries and applications for tie-ups are accepted from the following

URL: https://www.mirror-master.com/corporate_tie-ups

■Features of the application

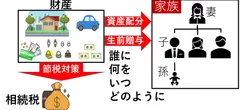

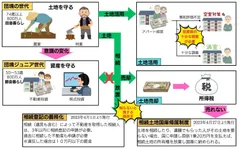

*Feature 1: Asset valuation and inheritance planning

Simulation of inheritance tax assessed value with consideration of inheritance measures by entering the details of assets such as bank deposits, real estate, and company stock.

Feature 1: "Easy Inheritance

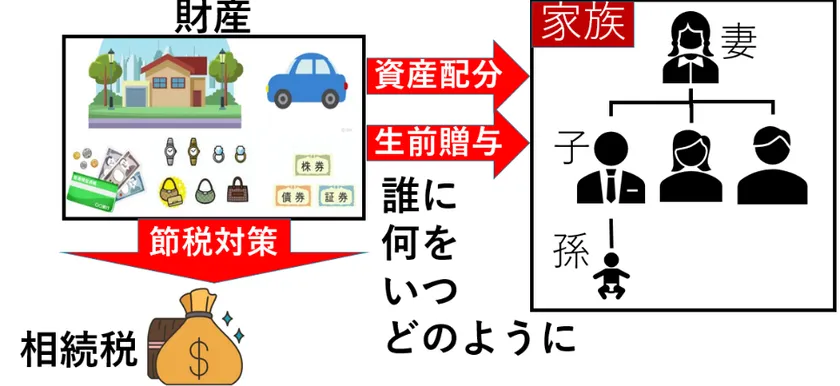

Feature 2: Inheritance planning that takes personal circumstances into account

Simulation of inheritance planning that takes into account tax-saving measures for personal property, asset distribution, and family circumstances regarding gifts before death, and how, what, when, and to whom inheritance is to be made.

Feature 2: "Easy Inheritance

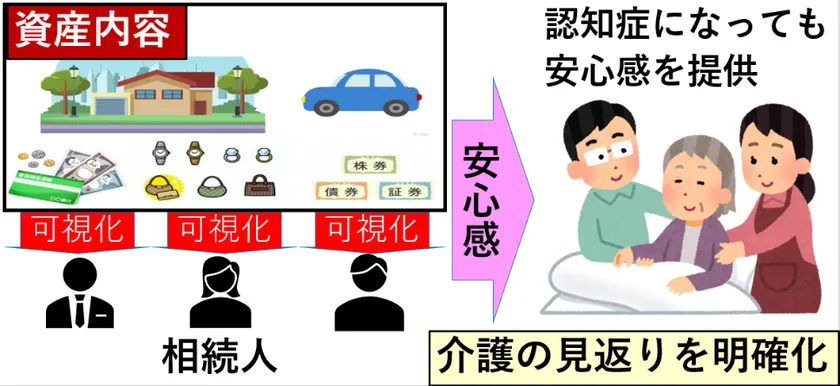

Feature 3: Provides peace of mind through visualization of inheritance

Provides a sense of security even in the event of dementia by visualizing the contents of assets to heirs and clarifying the return on care.

Easy Inheritance" Feature 3

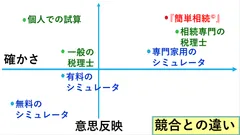

Easy Inheritance" is an inheritance tax calculation simulation software for individuals that manages assets throughout their lives, holding a unique position as an inheritance tax calculation system: "Comprehensive x Personal x Asset management", a product that sets it apart from its competitors.

Outline of "Inheritance tax calculation simulation software "Easy Inheritance

Application name : Inheritance tax calculation simulation software "Easy Inheritance

Date of release : Inheritance tax calculation software : March 1, 2024 (Friday)

End-of-life version: June 10, 2024 (Monday)

Life summary version: Scheduled to be released in July 2025

Supported OS : Windows environment running Microsoft Excel,

Web version will be available in 2026

Sales Price :

(Inheritance occurrence version)

・Lifetime use: 18,000 yen (19,800 yen including tax)

・Subscription: 980 yen (1,078 yen including tax)

(End of Life measures planning)

・Lifetime use: 160,000 yen (176,000 yen including tax),

・Subscription: 2,860 yen (1,078 yen including tax)

(Life Summary Version)

・Lifetime use: 300,000 yen (330,000 yen including tax),

Subscription: 3,600 yen (3,600 yen including tax)

Product sales page: https://www.mirror-master.com/store

For further information, please contact

Mirror Master LLC "Easy Inheritance" Customer Service Center

TEL : 0436-37-4976

Address: Ulma Building 416, 2-7-15 Goi Chuo Nishi 2-chome, Ichihara-shi, Chiba 290-0081, Japan

Inquiry form : https://www.mirror-master.com/contact

E-mail : admin@mirror-master.com

Home page : https://www.mirror-master.com

Inheritance Community : https://community.camp-fire.jp/projects/view/779357

- Category:

- Corporate Trends