To the president who is so focused on the company that he is putting off building his own assets The book "The President's Book on Growing Assets" will be published on October 29, 2012.

The authors of the book, which has sold over 200,000 copies The authors of "How to Change the Money You Earn and Build Assets by the Hundred Millionth of a Millionth of a Millionth of a Millionth.

星野書房

Hoshino Shobo (Representative: Tomoe Hoshino, https://silas.jp/ ) has published "A Book to Increase a President's Assets" (written by Hiroyuki Seino and Kyoji Hagiwara) on October 29, 2024.

This book is designed to encourage presidents who have been so serious about the growth and development of their companies that they have been putting their own affairs on the back burner to think about "increasing" their assets in preparation for their retirement, including pensions, retirement benefits, business succession before death, and inheritance measures.

According to the "National "President Age" Analysis Survey (2023)" (TDB Business View), the average age of presidents as of 2023 will be 60.5 years old. This age has increased for 33 consecutive years and is at an all-time high, according to the report. If healthy life expectancy is 75 years, the time left to live is not long.

While business succession and inheritance planning are important, it is also important to think about your own life and personal assets after you retire. This is a book that should be read by presidents who have been putting their own lives on the back burner while focusing solely on the company.

Cover of "The President's Book on Increasing Assets

<Features of this book

This book is a collaboration between Hiroyuki Seino, a tax accountant specializing in assets, and Kyoji Hagiwara, a life support company labor lawyer. Seino has published "The President's Asset Protection Book" (Selva Publishing), which is in heavy print in its previous edition, and Ogiwara has published 26 books to date and is an asset specialist for presidents. In this book, he thoroughly explains how to increase assets so that the presidents of the world, who are putting off building their own assets, can live "a life without regrets.

<Examples of specific know-how that we can share with you

Loans to directors and corporate auditors that have been lent to the company

Retirement benefits to be received when a manager retires.

The system for receiving government pensions.

Business succession and inheritance

<Background to writing this book

As a "tax accountant specializing in the president's assets," the author, Mr. Seino, has provided tax advice on inheritance and business succession to many business owners, and felt a sense of crisis that many of them were having problems with the president's personal assets. The popularity of his previous book, "Protecting the President's Assets," made him even more determined to "help presidents," which led him to write this book.

I felt that "keeping cash in the company is the first priority..."

"Well, I'm sure we can manage..."

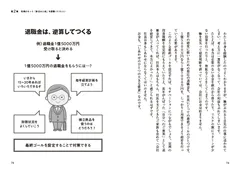

In this book, together with Mr. Kyoji Hagiwara, a labor and social security attorney, he thoroughly explains, with easy-to-understand illustrations, how to receive what you are supposed to receive, not through tax reduction or asset management.

This book is filled with the hope that you will live a "life without regrets" by receiving the directors' loans to your company, the government pension and retirement benefits you are supposed to receive, and spend your retirement years in peace after you retire bravely.

Contents of this book

Author's Introduction

Hiroyuki Kiyono

Hiroyuki Kiyono is a licensed tax accountant and administrative scrivener. He provides advice mainly in Ibaraki Prefecture, including tax return preparation for inheritance and gift tax, tax planning, advice on asset utilization such as real estate, and income tax return analysis for wealthy individuals. He has spoken at over 500 inheritance tax seminars and handles nearly 30 inheritance cases per year. He has consulted with clients in more than 3,000 individual meetings. He listens intimately to his clients and strives to be a good partner in their lives. He is the author of "Illustrated Guide to Inheritance Before Death" and "The President's Asset Protection Book" (Selva Publishing Co., Ltd.).

Kyoji Hagiwara

Social and Labor Insurance Consultant, Principal of the School of Workplace Design, and Representative Director of the Association for the Promotion of Personal Employment. He spent his life as a salaryman at a major company (Toshiba), but when he was 28 years old, his father was involved in a fraud and lost 300 million yen. In order to support his family, he became an insurance salesman with a full commission, but he was unable to obtain any contracts and was laid off. While working for an insurance company, he obtained a license as a labor and social security attorney and started his own business, becoming a charismatic laborer who earns 100 million yen a year on his own. He has authored 26 books and has appeared on numerous TV programs.

Book information

Title: "The President's Book on Increasing Assets

Author : Hiroyuki Kiyono, Kyoji Hagiwara

Price : 1,980 yen (tax included)

Release Date : October 29, 2024

Publisher : Hoshino Shobo Released by Sanctuary Publishing

Number of pages : 224 pages

Sales address : https://www.amazon.co.jp/dp/4801482597

Table of Contents

Chapter 1: Think about a "rich life" for the president

How the president enjoys life is important.

Are you living a rich life?

Advantages of business succession before death, etc.

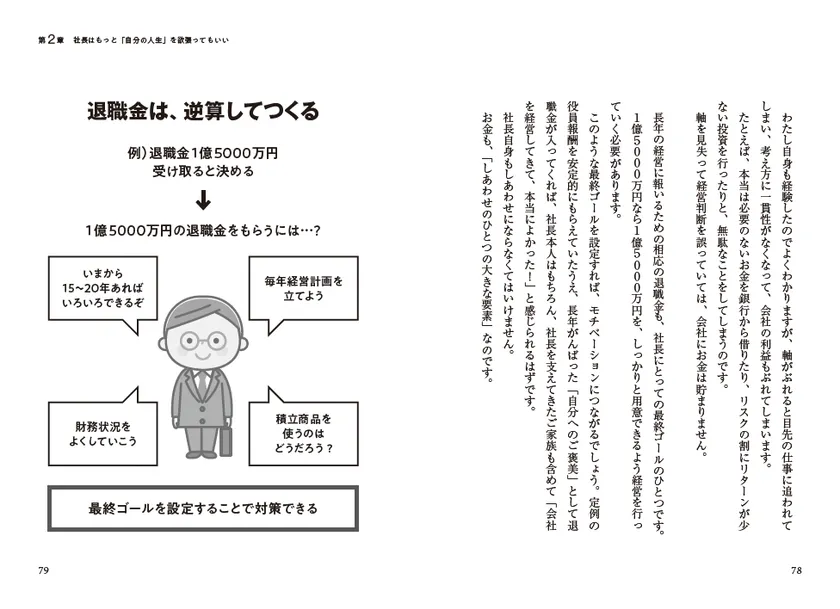

Chapter 2 It is okay for the president to be more greedy about "his/her own life

First of all, the president should be happy.

Let's make it a matter of course for the president to receive retirement benefits.

Create a financial situation that allows you to receive a reasonable retirement benefit.

Create a financial situation that provides adequate retirement benefits, etc.

Chapter 3: The president should design his/her own life

It is an important theme to think about the president's own life.

Let's draw a "life meter.

Let's create a life meter for three generations, etc.

Chapter 4: Receive the president's pension benefits

Public pension for the president is special

Basic knowledge of public pensions

How to receive a pension from age 65, etc.

Chapter 5: Secure retirement benefits for the president

Basics of the president's retirement allowance

Cases that cause problems with retirement allowances for directors and corporate auditors

Checklist of retirement allowances for executives, etc.

Chapter 6: Live with peace of mind through business succession and inheritance measures during your lifetime

Prosperity" brought by business succession and inheritance

Think about the best retirement

How to relate with people that will lead to an amicable business succession, etc.

- Category:

- Goods