What FX Traders Really Think: Top 10 FX Trading Worries as Told by 300 Traders! [Survey Results Released]

Key challenges and solutions from the real voices of FX traders

Song合同会社

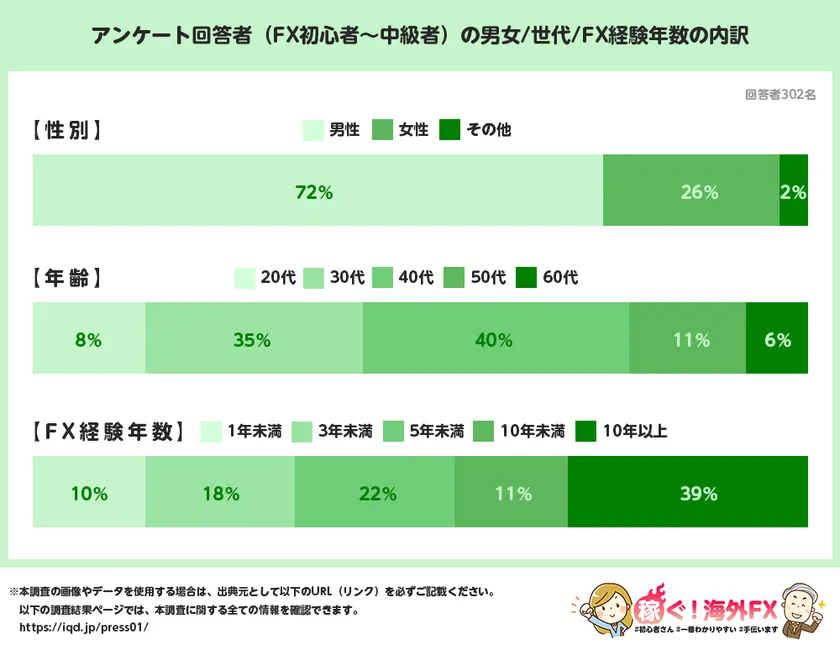

Song LLC (Chuo-ku, Tokyo / President: Kendrich Karl Luna) conducted a survey of 300 traders involved in forex trading regarding the main challenges they face in their trading. The survey was conducted between September 1 and September 10, 2024, and aimed to determine what challenges traders are facing and how they are coping with them.

The real story of FX traders: Top 10 FX trading problems as told by 300 traders!

[Survey Summary

Survey period : September 1 to September 10, 2024

Survey method : Questionnaire survey

Survey target : 302 beginner to intermediate traders

Name of Survey Company : Song LLC

E-mail address : info@song.co.jp

URL : https://song.co.jp/

Breakdown of Survey Respondents

Breakdown of survey results

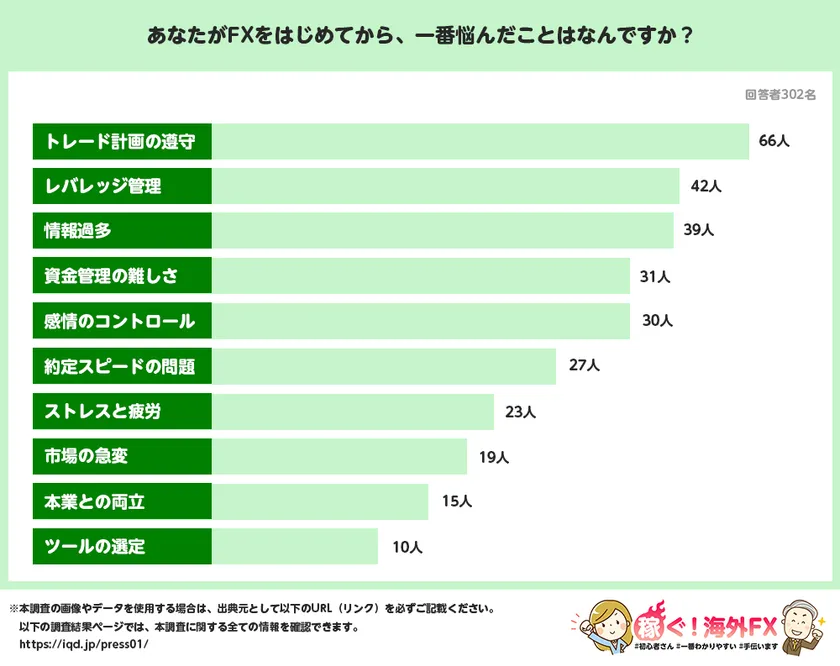

The survey results can be summarized as the following major concerns, which are commonly experienced by many traders in FX trading.

1. adherence to a trading plan

2. leverage management

3. information overload

4. difficulty in money management

5. emotional control

6. problems with execution speed

7. stress and fatigue

8. sudden changes in the market

9. balancing work and family life

10. selection of tools

The closest thing to a problem I have had since I started Forex

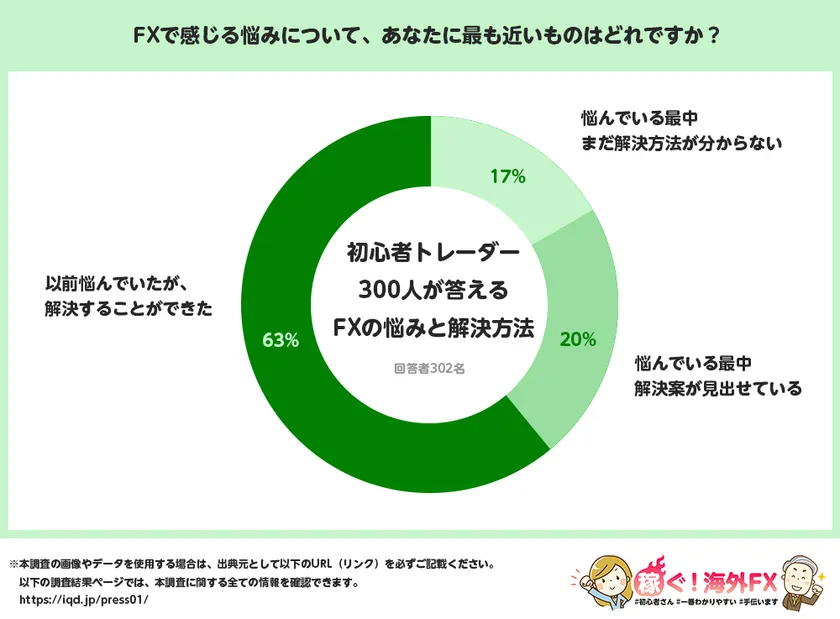

The closest thing about the worries you feel about Forex

Each chapter presents specific experiences with these worries and delves into how real traders are dealing with them.

■ Chapter 1: Adhering to a Trade Plan

40-something male, government employee: "My losses increased because I could not adhere to my trading plan. Since keeping a trade diary, I have been able to stick to my plan."

30s male, self-employed "I couldn't trade according to my plan and losses continued, but after reviewing my plan, they have stabilized."

50s, female, housewife: "I could not follow the plan and my losses increased. I reflect on this in my trading diary and try to follow the plan."

40s, female, salesperson: "It was difficult to follow the plan and losses continued. Reviewing the plan worked."

30s, male, IT industry: "I traded without following the plan and losses increased. Reflection and revision of the plan brought stability."

Chapter 2: Managing Leverage

30s female, insurance industry "I lost a lot of money due to excessive use of leverage, but I started to manage my position size using risk management tools, and now I can make a stable profit."

40s, male, public employee: "I incurred losses due to high leverage. I reviewed my risk management and am now stable with appropriate leverage."

50s male, self-employed: "I used leverage incorrectly and my account was temporarily depleted. Improved by strictly managing risk."

Female student in her 20s: "I made a mistake in setting leverage and lost a lot of money. After that, I used risk management tools to reduce my risk."

30s, male, sales staff: "Losses increased due to excessive use of leverage. With proper management, I am now able to trade stably."

■ Chapter 3: Information Overload

30s, male, self-employed: "There was too much information and it was difficult to sort through it. I improved it by narrowing it down to important information."

40s, male, salesperson: "The sheer volume of market information overwhelmed me and made it difficult to make transaction decisions. I reviewed the selection process."

50s, female, housewife: "There was so much information that it was difficult to analyze. I improved by focusing on key information."

Male student in his 20s "I was overwhelmed by the large amount of information and found ways to focus on the important data."

60s male retiree "Confused by information overload. I dealt with it by focusing on reliable sources of information."

■ Chapter 4: Difficulties in managing funds

40s male government employee "The account balance was in jeopardy due to difficulties in money management. We reviewed and found stability."

30s, female, insurance business: "The allocation of funds did not go well, and it affected my transactions. We improved the management method."

50s, male, self-employed: "Losses increased due to difficulties in fund management. With proper management, I improved."

20s male student "Proper distribution of funds was difficult and improved by reevaluating management methods."

60s male, retiree "It was difficult to manage funds and losses continued, but with systematic management, they stabilized."

■ Chapter 5: Emotional Control

40s male salesperson "Losses increased due to emotional trading. Learning how to trade calmly stabilized me."

30s, female, insurance business: "My losses increased because I could not control my emotions, but I improved by trying to make calm decisions."

50s, male, self-employed: "My trading became unstable due to my emotions. I improved by being disciplined in my dealings."

Student, male, in his 20s: "I was swept away by my emotions and transactions became difficult. I acquired the skills to deal with it calmly."

Retiree, male, 60s: "I was unable to control my emotions and transactions failed. I stabilized it by thoroughly managing my emotions."

Chapter 6: Speed of Execution

60s male retiree "Execution speed was slow and trading did not go well, but switching to a reliable ECN account has greatly improved things."

40s male government employee "I sometimes missed trading opportunities due to slow execution speed. I reviewed my account and improved it."

50s female housewife "Execution speed was slow and trading did not go smoothly, but the problem was solved when I switched accounts."

30s male, IT industry "The execution speed was so slow that it interfered with my trading. I switched to a more reliable platform and that improved things."

20s, female, student "Execution speed was slow, which was a problem, but I took remedial measures and smooth transactions became possible."

■ Chapter 7: Stress and Fatigue

40s, male, salesperson: "Stress from trading affected my performance. With rest and stress management, I improved."

30s, female, insurance business: "Trading fatigue caused lack of concentration. Rest and time management helped me cope."

50s, male, self-employed: "Stress had a negative impact on my trading. I improved by managing my stress thoroughly."

Student, male, in his 20s: "Performance declined due to trading stress. Mental health care helped me cope with it.

60s male retiree: "Fatigue from trading had an impact. Refreshing methods improved my performance.

Chapter 8: Abrupt change in the market

50s male, real estate agent "I suffered losses many times due to sudden changes in the market, but I reduced the risk significantly by setting stop-losses and diversifying currency pairs."

40s Male Government employee "I could not respond well to sudden changes in the market and my losses increased. Stop loss and diversified investments helped."

30s, female, self-employed: "I suffered losses because I could not respond to sudden market changes. Setting stop-losses improved my situation."

20s, male, student: "I continued to incur losses due to sudden changes in the market. After strengthening risk management, it stabilized.

60s male retiree "I was swept away by the rapidly changing market, but I was able to reduce my losses by reviewing my risk management."

■ Chapter 9: Balancing Work and Main Business

40s male educator "I introduced an automated trading tool in order to continue trading even when I am busy with work. This has made it easier for me to balance trading and my main job."

30s, female, medical professional: "My shift in the medical industry is irregular and it is difficult for me to time my trades. I balance both by utilizing the smartphone application and trading at night."

50s, male, corporate executive: "In order to balance my busy work as an executive with trading, I use my spare time to trade. Time management is key."

40s female freelance trader "I have free time as a freelancer, but I plan my trading time and balance it with my work."

30s male, technical worker "It is difficult to balance a technical job that requires concentration with trading, but I achieve this by planning the timing of trades and conducting research regularly."

■ Chapter 10: Tool Selection

50s male, real estate business "I had a hard time selecting an appropriate tool. We changed to a reliable tool and made improvements."

40s, female, salesperson: "Tool selection did not go well, affecting transactions. We found the most suitable tool and improved it."

30s, male, IT industry: "Efficiency deteriorated due to tool selection error. We introduced an improved tool and made improvements.

20s, male, student: "We could not find an appropriate tool, which hindered our trading. We switched to a better tool and improved."

Male retiree in his 60s "Tool selection problems prevented smooth trading, so I switched to a reliable one."

The first step to solving the problem is to become aware of the issue.

This survey revealed various challenges in FX trading.

Because achieving success requires comprehensive consideration of multiple factors and flexibility,

1. overall strategy review

2. data analysis

3. emotional control

We see a trend that many traders are taking measures such as

Let's work to find the appropriate approach for your own situation.

- Category:

- Research & Reports

- Genres:

- Finance Other Lifestyles Economy(Japan)