Crowdfunding for the completion of the entire series of the inheritance tax calculation simulator "Easy Inheritance Crowdfunding on CAMPFIRE until September 30 (Monday)

ミラーマスター合同会社

Miller Master LLC (located in Ichihara City, Chiba Prefecture) will challenge a project on the crowdfunding platform "CAMPFIRE" until September 30 (Monday) in order to complete the entire series of the very popular inheritance tax calculation simulator "Easy Inheritance".

Reduce inheritance expenses to the limit! Don't leave inheritance to others! Easy Inheritance" to realize "Easy Inheritance"!

URL: https://camp-fire.jp/projects/778013/view

Crowdfunding Main image1

The Importance of Doing Inheritance Tax Calculations Yourself

Inheritance tax is a tax that is imposed on those who have an estate of 50 million yen or more.

50 million yen is an amount that would be quickly achieved if you own your home and have about 20 million yen in savings. According to data from the IRS, there are more than 130,000 people who file inheritance tax returns each year.

Since there are about 1.5 million deaths each year, this means that one out of every 10 deaths will be subject to inheritance tax.

The inheritance tax rate is progressive, with a maximum rate of 55%.

If you ask a professional tax accountant to file your inheritance tax return, it will cost at least ¥500,000.

However, just because a person is a licensed tax accountant does not mean that he or she is truly knowledgeable about inheritance matters.

In addition, the tax office will thoroughly collect taxes on the small amount collected, but will not return taxes on the large amount collected unless you speak out.

It is natural that we should control our inheritance assets ourselves. If we leave it to tax attorneys and other people, we will lose a great deal of money.

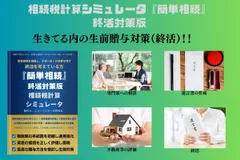

This is true not only when an inheritance occurs, but also when you are thinking about end-of-life planning and your second life in the future.

It is the new normal from now on to control our own property by ourselves.

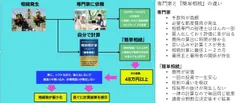

The Difference between Professional and Simple Inheritance

■What is the inheritance tax calculation simulator "Easy Inheritance"?

I lost my parents several years ago and experienced two inheritances. At that time, I realized that it is not enough to ask a tax accountant for inheritance tax; if you do not verify the inheritance tax by yourself properly, you will pay wrong inheritance tax.

In order to avoid such unreasonable feelings, we have packed our knowledge of inheritance into "Easy Inheritance" so that "everyone can be convinced of the importance of inheritance tax returns and life after death! We have already produced two of the three products in the series.

Inheritance Occurrence Edition and End-of-Life Planning Edition

However, awareness of "Easy Inheritance" is still low.

Therefore, with your help, we would like to help as many people as possible who feel unreasonable when it comes to inheritance by "■increasing awareness of the product and ■developing further enhanced functions". We would appreciate your cooperation in this endeavor.

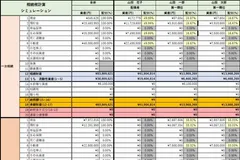

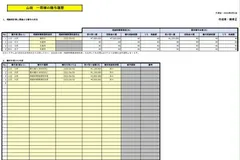

Easy Inheritance" is a simulation software that allows individuals to calculate inheritance taxes.

The act of inheritance has the great purpose of "leaving as much property as possible to one's descendants so that they may prosper. Furthermore, there is an important mission of "enjoying a rich life as a human being and contributing to society.

Living a prosperous life and contributing to society leads to the prosperity of mankind, which in turn leads to the happiness and prosperity of one's descendants.

Since there are various backgrounds of people considering inheritance, we have decided to systemize "Easy Inheritance" by considering three situations that fulfill the purpose of the desire for inheritance.

To acquire as much property as possible without reducing it.

To leave as much property as possible to one's children and grandchildren, and to distribute it in a way that prevents disputes.

To live a rich life to leave a proof of one's life.

In order to make it possible to purchase this "Easy Inheritance" according to the needs and difficulty level of the user, we have decided to develop three products: "Inheritance Occurrence Edition," "End-of-Life Planning Edition," and "Life Summary Edition.

■Project Outline

Project name: "Reduce Inheritance Expenses to the Limit!

Don't leave inheritance to others! Development of "Easy Inheritance" that realizes

URL : https://camp-fire.jp/projects/778013/view

Target Amount : 1,000,000 yen

Date of application : August 13, 2024 (Tue) - September 30, 2024 (Mon)

Returns

Message of thanks 3,000 yen (tax included)

Startup - Challenge story of the crafan 5,000 yen (incl. tax)

Ichihara City, Chiba brand vegetable "Anesaki Daikon" 5,000 yen (including tax and shipping)

Peanuts with pods "Hantate" from Chiba Prefecture 8,000 yen (including tax and shipping)

Inheritance tax calculation simulator "Easy Inheritance" Individual inheritance consultation 20,000 yen (tax included)

Name on the website 30,000 yen (tax included)

Inheritance tax calculation simulator "Easy Inheritance" Inheritance occurrence version 13,860 yen (tax included)

Inheritance tax calculation simulator "Easy Inheritance" - Life Planning version - 138,600 yen (tax included)

Inheritance Tax Calculation Simulator "Easy Inheritance" Life Summary Edition: 255,500 yen (including tax)

Reseller rights for "Easy Inheritance" (agency contract) 280,000 yen (tax included)

Rights to request customization of developed products 400,000 yen (including tax)

For inquiries regarding this matter, please contact

Mirror Master LLC "Easy Inheritance" Promotion Department

Contact: Takamasa Kagami

Address: Uruma Building 416, 2-7-15 Goi Chuo Nishi, Ichihara City, Chiba Prefecture

Telephone number : 0436-37-4976

E-mail : support@mirror-master.com

Home Page: https://www.mirror-master.com

- Category:

- Announcements & Recruitment

- Genres:

- Finance Other Lifestyles General Business