NISA "Asset Formation" Support Program for Corporations ~Starts operation on July 5 ~ Introductory briefing sessions to be held as needed.

IFA JAPAN(R)株式会社

IFA Japan(R) Corporation (Head Office: Bunkyo-ku, Tokyo; Representative Director and CEO: Yuichi Arakawa), an investment advisory firm highly regarded for its "Portfolio Management Service (PMS)" using domestic and foreign funds, will launch a corporate NISA "Asset Building" support program service on July 5, 2024, utilizing the NISA (small amount investment tax exemption) system that was expanded from this year. (Bunkyo-ku, Tokyo, CEO: Yuichi Arakawa) will launch a corporate NISA "Asset Formation" support program service on July 5, 2024.

NISA "Asset Formation" Support Program for Corporations ↓

Service introduction page

<Service Overview

This is a "welfare benefit plan" for corporations utilizing the NISA (Small Amount Investment Tax Exemption Scheme), which has been greatly expanded from 2024. We provide "investment plans (model portfolios)" using publicly offered domestic investment trusts to support "asset building" of executives and staff.

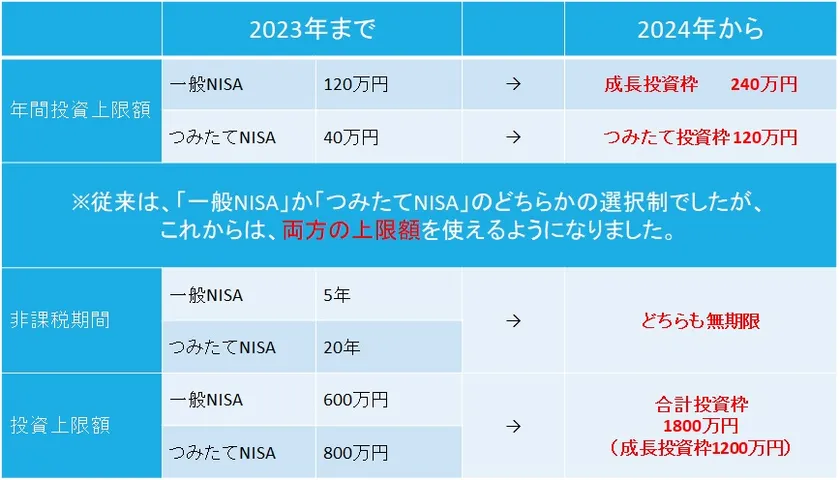

What is NISA (small amount investment tax exemption)?

Starting in 2024, the tax exemption limit has been greatly expanded and the tax exemption period has been indefinitely extended in order to support the "asset building" of the Japanese people. It is a national system that will be the core of "asset formation" in the future.

Comparison of old and new NISA

2. investment plan (model portfolio)

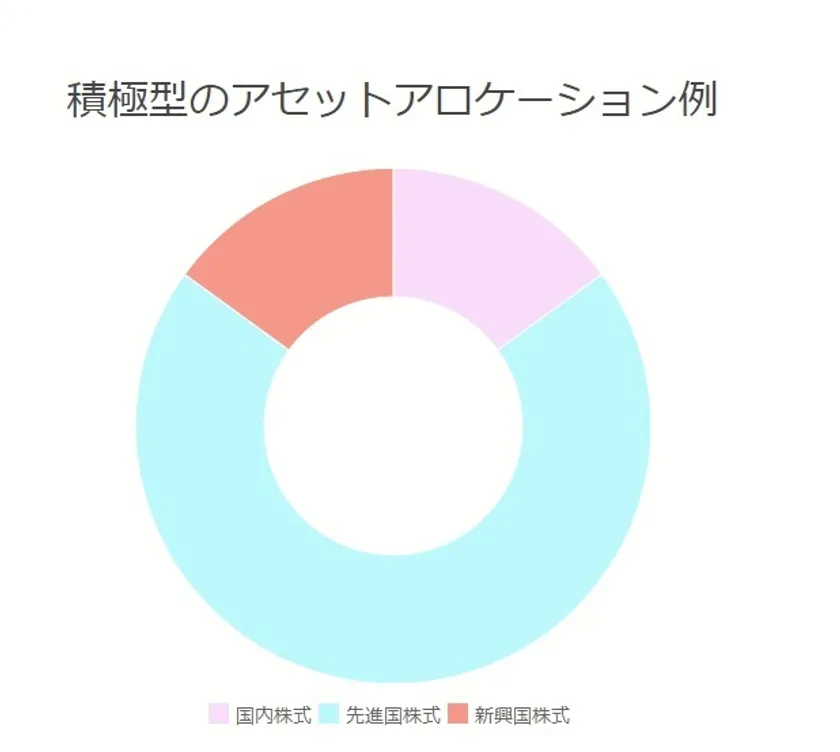

The financial institutions we expect to use are major online securities companies that offer low fees and a large selection of stocks. Based on our original investment strategy, we offer three types of "investment plans" (Aggressive, Balanced, and Income) that can be started with a small amount in savings.

Aggressive Portfolio

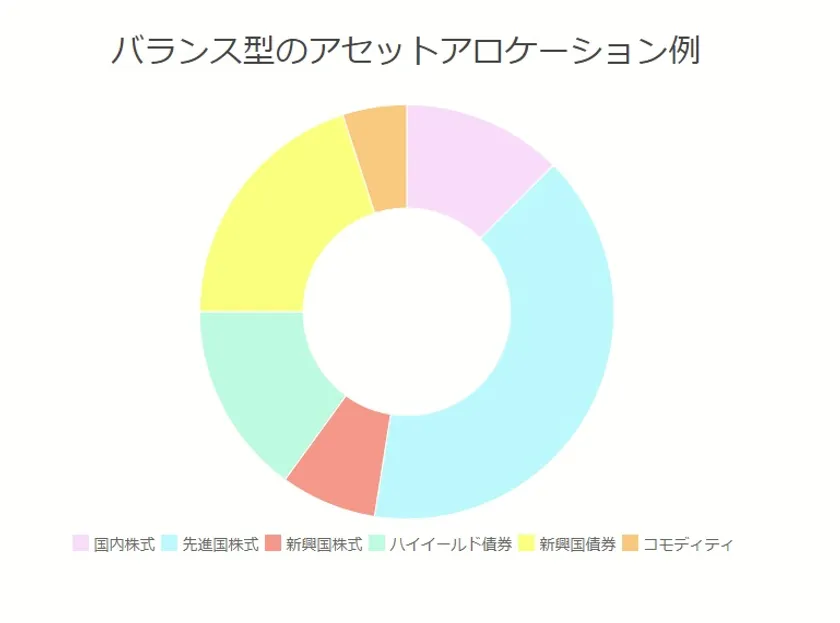

Balanced Portfolio

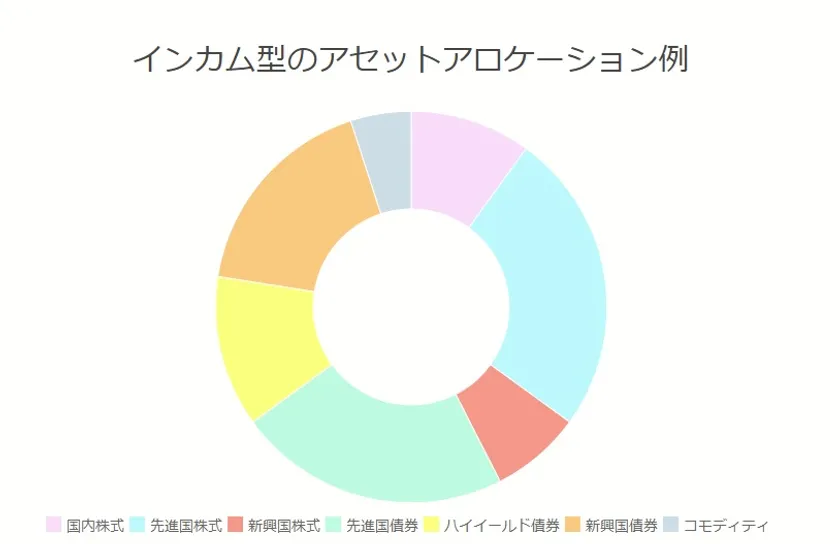

Income Type Portfolio

Steps to introduction

Step 1: Explanation of the "NISA Asset Formation Support Program" to the management and staff in charge

If you are willing to introduce the program, go to Step 2.

Step 2: Hold "NISA Asset Formation Support Program Briefing Session" for employees

After the briefing session, please confirm your company's needs and decide whether or not to adopt the program.

We will provide support up to Steps 1 and 2 free of charge.

Step 3: Sign up and register prospective subscribers

Step 4: Hold an "investment plan briefing (investment study session)" for subscribers.

*If the plan is to be introduced, this can be done at the same time as the briefing in Step 2.

Step 5 Provide "investment plan (model portfolio)

Start of advisory service

4. service details

1) "Investment Plan Briefing (Investment Study Session)" for subscribers

2) Provide three types of "investment plans" (active, balanced, and income type)

3) Sending advice letters to the corporate office when there is a change in the contents of the plan

4) Responding to questions from the advice recipient via e-mail or telephone (as needed)

5) Hold one-on-one consultation once a year with the advice recipient (if desired) (at our office or via Zoom)

NISA "asset building" support program for corporations (free individual consultations) is currently being implemented!

In addition to explaining the program, we also provide consultations on various asset management issues for our clients at individual consultations. We can also help you create a "portfolio," review your financial assets, and give you a second opinion before purchasing financial products. Please feel free to contact us for a consultation.

https://www.ifa-japan.co.jp/services/nisa-consulting-request-form/

■Company Profile

(1) Company name: IFA JAPAN(R) K.K. (https://www.ifa-japan.co.jp/)

(2) Representative: Yuichi Arakawa, Representative Director and CEO

(3) Registration No.: Director of Kanto Local Finance Bureau (Kinsho) No. 486

(4) Member Association: Japan Investment Advisers Association Membership Number: 012-02324

(5)Member Organization: Tokyo Chamber of Commerce and Industry, Membership No. C2679531

(6)Location of Head Office: 3F Tour Building, 1-25-5 Hongo, Bunkyo-ku, Tokyo

(7)Date of establishment: February 2001

(8)Main business: Supporting the introduction of defined contribution company pension plans and providing investment plans (advice)

Providing investment plans (advice) and "portfolio management" using domestic and foreign investment trusts, ETFs, and overseas funds.

Advisory services for "portfolio management" using domestic and foreign mutual funds, ETFs, and overseas funds,

Providing information on overseas financial products, diagnosis of investment trusts and ETFs, and

Diagnosis of investment trusts and ETFs and provision of portfolios

(9) Capital: 10,000 thousand yen

This document is a press release prepared by the Company and is not a disclosure document under the Financial Instruments and Exchange Act. The contents of this document are current as of the date of preparation, and are subject to change without notice. This material is based on information that we believe to be reliable, but we do not guarantee its accuracy or completeness. The data, analysis, etc. in this material are based on actual results for a certain period of time in the past, and are not intended to guarantee or predict future investment results or market environment fluctuations. For more detailed information, please contact us.

- Category:

- Services

- Genres:

- Finance General Business Economy(Japan)