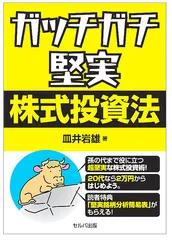

Practical book on asset building to be read in your 20s Gatchigakuchi Solid Stock Investing Method" No. 1 on Amazon's New Arrival Ranking Started sales in stores on October 13, 2012

合同会社サライクリエイト

Sarai Create LLC (located in Tokoname City, Aichi Prefecture; Representative Employee: Iwao Sarai) released a new book, "How to Invest in Stocks with Stiff Stocks," on Amazon on Monday, October 9, 2023, which describes a procedure for investing in solid assets that you should read in your 20s, and it was ranked No. 1 in the Financial Industry category of Amazon New Arrivals Ranking The book was ranked No. 1 in the Financial Industry category of Amazon's New Arrivals Ranking. This book will also be available at Sanseido Bookstore starting Friday, October 13, 2023.

Details of "Gotchi Gotchi Solid Stock Investment Method": https://kataikabu.jp/book-kenjitsu/

Cover of "Gatchigatchi-Gatchi-Solid Stock Investment Method

About "How to Invest in Stocks with Steady Hands

This is a practical book that describes a procedure for building assets through "Gotchi Gotchi Solid Stock Investment Method" to avoid making investments a gamble, which was arrived at after repeated failures and trial and error in 35 years of investment experience by a fourth-generation investor who grew up in a family where the ups and downs of the family business were covered by stock investments.

I taught it to my own children.

It is a story that shows how money works in the world from an investment perspective.

What to believe and what is dangerous in investing in stocks.

How to safely build assets.

What you should always check when choosing stocks.

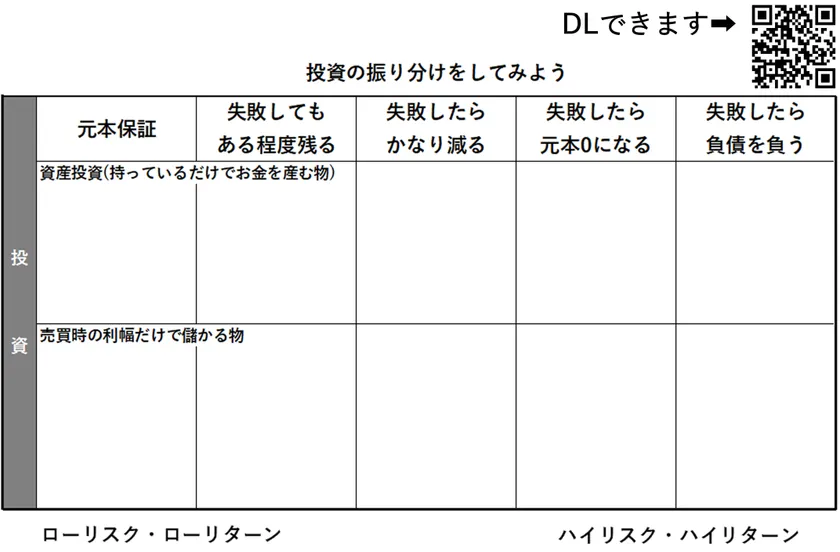

The contents of this book are for practical use, with a stock checklist available for download.

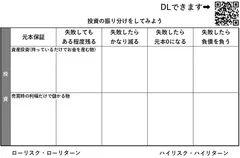

Let's divide investments by type.

<Table of Contents

Introduction If I had the knowledge I have now in my 20s: ......

Chapter 1 Why I recommend stocks to my loved ones

1 Get money, freedom, and health from inside and outside the industrial structure pyramid.

2 Cash and mutual funds will not erase the fear of losing money.

Cash and mutual funds won't erase the fear of retirement.

Fund managers can lose 10 billion yen and still not lose money.

3 With stocks, retirement funds are worth twice as much as cash.

∙ There is a difference between "20 million yen in savings" and "20 million yen in stocks

4 Japan has no distinction between gambling and solid investment

Stocks are the least suitable investment for gambling.

When stock investment becomes a real asset investment

5 Why I chose stocks as a solid investment

Stocks are the fairest investment.

Only stocks can grow on their own.

6 A businessman is the strongest in solid stock investment!

Chapter 2 Why ordinary people cannot win in stocks

1 I lost money by doing this

2 When the stock price moves

What is the day when the stock price always moves?

What is the season when investors flock to the underbelly of the market?

3 Risks of reading stock charts

Ordinary people cannot win in trading.

Chapter 3: 99% of Japanese misunderstand stock investment (Important basic knowledge from an investment perspective)

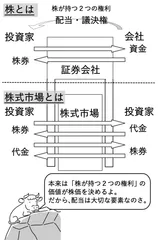

1 Can you answer "What is a stock in the first place?

2 [Important] What you can see when you look deeper into dividends

Dividends reveal the company's management policy.

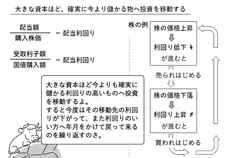

3 [Very important] The world's huge money is going here.

If you don't understand the difference between interest rates and yields, you will lose money on your investments for the rest of your life.

Big money wants "solid and safe.

4 What is the stock whose stock price will surely rise?

5 What is the investment method that will surely save a lot of assets?

6 Become an investor who rejoices when the stock market crashes.

The Dollar-Cost-Per-Click Method

Chapter 4: If you don't know, you will remain a gambler all your life! Stiff Timing and Buying Decisions

1 Make money where it is natural to make money.

2 Invest when all the money is on your side.

3 It's a no-brainer for seasoned investors; 99% of people don't know how to get free stocks and peace of mind.

. Your solid investment will save Japan and your children in the future.

4 How to safely buy and sell stocks to build assets

Chapter 5 Then, what kind of stocks should I choose? Conditions for selecting stocks for a gutsy, solid investment

1 Risk of buying stocks for plausible reasons

1 Risk of buying stocks for plausible reasons 2 Financial indicators PER and ROE that are too risky

Don't believe the legend of P/B ratio of 1.0

Don't buy stocks for plausible reasons.

2 My recommended procedure for finding a solid stock to buy.

3 Draw a line on the stock chart.

Investors who dance around with conveniently cropped stock charts and patterns

4 Let's rule out these stocks

5 Know the company's growth potential and risk factors

Conclusion

Reader's Special Present

<Outline of the book

Title: "Gatchi-Gatchi Solid Stock Investment Method

Author : Iwao Sarai

Price : 1,650 yen (tax included)

Release date: Amazon October 9 (Mon.) / Bookstores October 13 (Fri.)

Number of pages: 168 pages

Specifications: B6, B&W

ISBN : 978-4-86367-848-4 C2033

Publisher : Selva Shuppan https://seluba.co.jp

Amazon : https://www.amazon.co.jp/dp/4863678487/

Author's Profile: Iwao Sarai

Born in 1966 in Aichi Prefecture, Japan Graduated from Tokyo University of Agriculture, Faculty of Agriculture.

After returning from the Russo-Japanese War, my great-grandfather took advantage of a profitable opportunity and lost his fortune in margin trading, and his family and he was chased by debt collectors. To pay off his debts, my grandfather went to work and steadily bought stocks instead of saving money. His father lost an astonishing amount of money by getting involved in funds and trading, as recommended by a securities salesman. The author grew up hearing various stories about money from his grandfather and watching him invest in stocks from an early age. After graduating from college, at the same time as the bursting of the bubble economy, he began to invest in stocks while working as a self-employed stockbroker, but his funds were soon reduced to one-third of what they had been. Then, even during crashes such as the China Shock and the Corona Shock, he had his own investment theory and techniques for analyzing stock issues, waiting for unrealized profits without panicking. He has been teaching many Japanese people, who are now being driven by money with a sense of value fueled by the media and advertisements, and are about to lose their precious money earned through labor and feelings of happiness, to "have assets that will generate money in the future as the foundation of life" and to "live richly with laughter on that secure foundation". He has begun to teach people how to make solid investments in stocks.

Company Profile

Company name: Sarai Create LLC

Representative: Iwao Sarai, Representative Partner

Location: 5 Maedamen, Hirome, Tokoname, Aichi, 479-0808, Japan

Establishment : September 2013

Business description: Mail order sales and brokerage, stocks, real estate, and other related businesses

Capital : 500,000 yen

For inquiries about this book, please contact

Gatchigachi Solid Stock Investment Research Institute (operated by Sarai Create LLC)

Inquiry form: https://kataikabu.jp/quest/

- Category:

- Goods

- Genres:

- Finance Books & Magazines Other Lifestyles